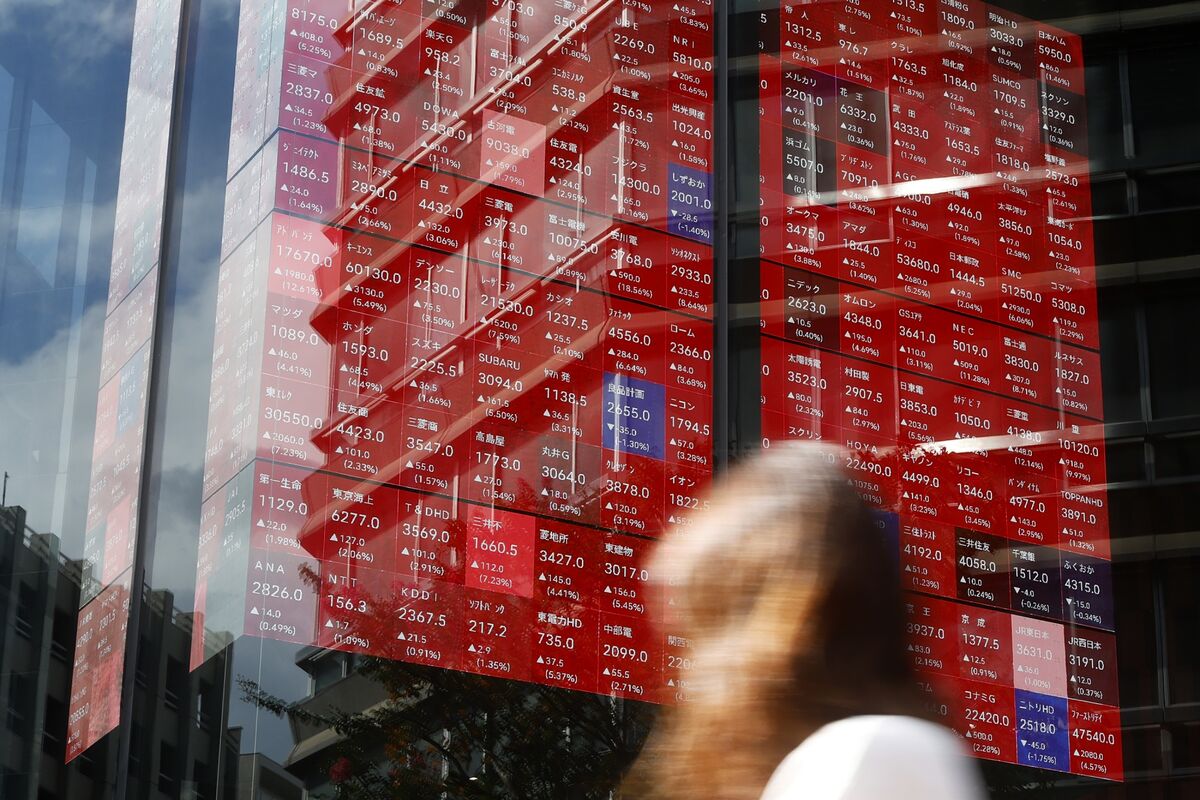

If you care about GPUs, latency, or not getting priced out of Nvidia, you probably need to start paying serious attention to Asia’s AI stock boom.

Developers keep asking, “Where is all this AI compute going to come from?” Today’s answer: a lot of it is quietly being financed in Asia’s stock markets.[2] Asia’s tech stocks have kicked off the year on a tear, with investors explicitly piling in because of surging AI demand and the region’s central role in the semiconductor supply chain.[2] While everyone is doomscrolling US big-tech earnings, long‑term funds are quietly overweight Asia and calling more upside from AI.

Why should you, as a developer, care about some bankers in Hong Kong and Singapore shuffling portfolios? Because this is the stuff that decides whether you get cheaper GPUs, more regional cloud options, and better latency for users outside the US. Strategists at Goldman Sachs are openly saying they expect further gains because of AI infrastructure demand, and Citigroup is seeing global investors accumulate Asian chip and hardware names.[2] Translation: more fabs, more advanced packaging, more capacity for the models you want to run.

Practically, this could mean a few things for us:

- More regional AI clouds and inference providers popping up in Asia.

- Potentially better pricing competition for training and serving, especially if US hyperscalers don’t move fast enough.

- A stronger ecosystem around edge devices, phones, and custom accelerators built closer to where they’re manufactured.

If you’re deploying globally, this is the moment to ask: should you be betting your entire stack on US‑centric infra, or is it time to start experimenting with Asian cloud/AI providers to hedge your risk and improve latency for your users there?

Source: Bloomberg